Is your business in the dark over its customs charges?

Parcel Operators offer many benefits when moving your business’ goods – speed, cost effectiveness and reliability.

But many businesses do not understand the charges applied for these services.

We have recently launched a new Customs Health Check service designed for SME businesses.

The benefits to SMEs:

- It is low cost

- It is quick and easy. It takes no more than 10 minutes of your time. Literally, answer a few questions and send us some sample paperwork.

- Potential to save thousands of £/€ in duty and VAT payments

- Eliminate risk from your supply chain

- Get peace of mind that you are compliant

- Initial assessment is completed with actions identified.

For larger organisations we also provide a more comprehensive Full Business Customs Health Check.

The more in-depth customs health check is generally more suited to larger organisations who require a wider review of their customs process. An outcome from this Customs Health Check is a full report including recommended actions and next steps to take. The areas covered include:

- Reviewing your import and export movements

- Examine the current level of compliance for customs and VAT

- Assess your tariff classifications, valuation and origin

- Review your current process for completing customs declarations for effectiveness, efficiency and data security

- Checking effectiveness, efficiency and security of duty and VAT payments process

- Assess and review potential for customs special procedures and reliefs

- Advise on how to deal with revenue post clearance audit checks

Sample Scenario:

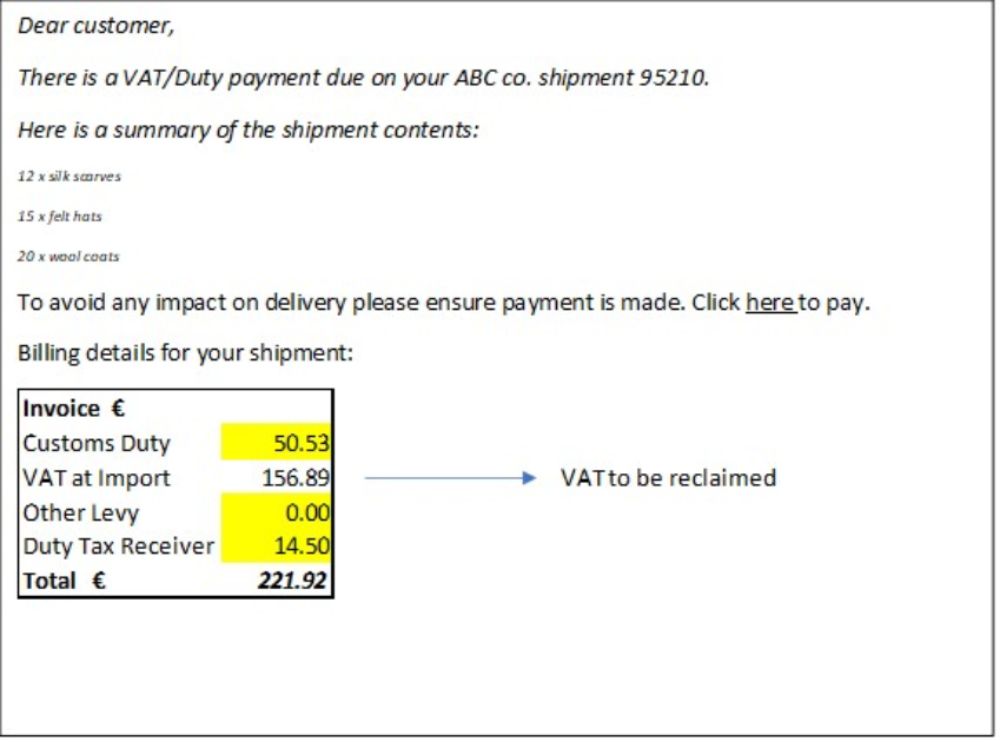

A recent example was an Irish SME client who had received several ‘payment due’ notifications from a parcel operator. Our client was concerned that the charges due seemed excessive and contacted their UK supplier.

The UK supplier advised these were the parcel operator’s fees.

The parcel operator advised these were ‘Brexit’ fees.

Neither is correct!

For parcel recipients it is important to understand the breakdown of charges levied.

Customs duty may/may not be due on the goods you have ordered – the amount of duty is determined by several factors such as item commodity code, value and cost of transportation.

All standard VAT rated items will have VAT at a rate of 23% (ROI) or 20% (UK) due on the value of the item

In the sample scenario above, the net cost is only €65.03 as opposed to €221.92. The key thing for a trader is to ensure that their accountant/bookkeeper is reclaiming the VAT on these types of imports.

In the above €156.89 should be reclaimed through the trader’s VAT return. We would also recommend a full analysis of all previous imports completed on the trader’s behalf through a parcel operator. Easy Customs are here to help in this scenario.

Contact our team to assist you today!