Brexit has happened (Finally!): What has changed?

At the 11th hour a deal was thankfully agreed between the EU and the UK.

There was a misconception out there for many, that a deal meant that customs declarations would not be required. Unfortunately, this is not the case.

For this reason, it is vital that businesses seek advice now. Traffic in the early part of the year has been slower than normal and many have been caught out by the changes.

Below we have summarised the main changes that have come about from 1st January 2021

.

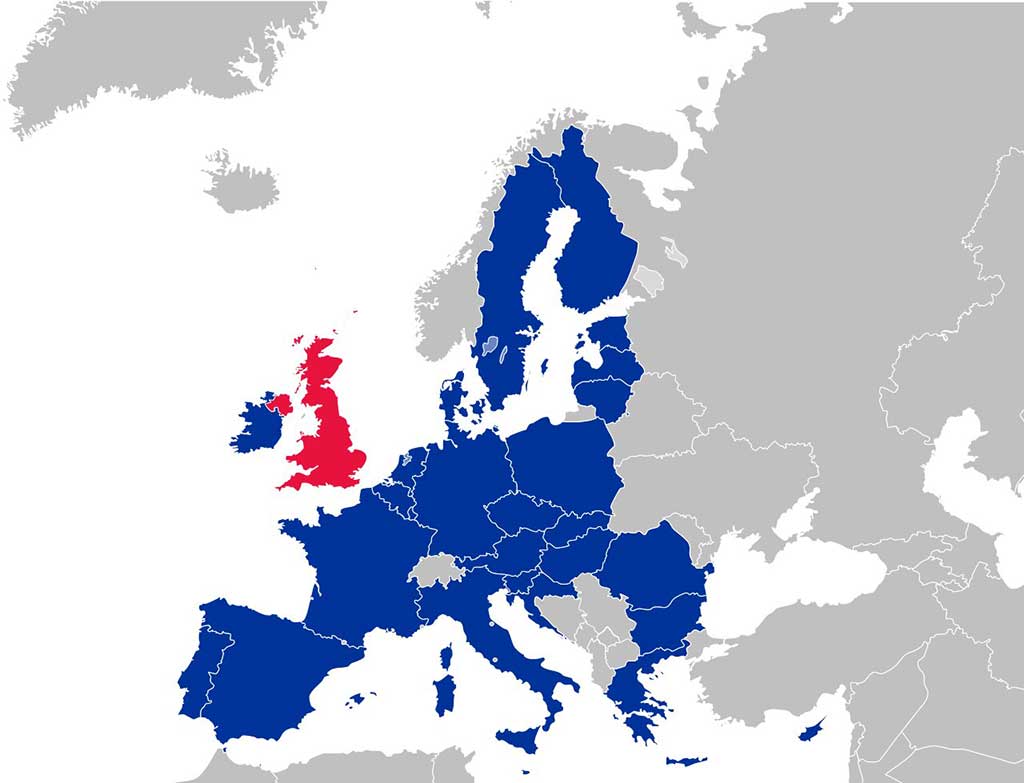

1 – UK – “Third country” & NI protocol

The main change is that the UK has left the Customs Union and the Single Market, which will have a huge impact on people and business owners in Ireland who send goods to, from or through the UK. This means that the EU – and by extension, Ireland, will treat Great Britain as a ‘third country’ for the purposes of trade.

However Northern Ireland (due to its unique circumstances) has its own special rules (Northern Ireland protocol). NI is part of the UK’s customs arrangement BUT is also aligned to the EU Customs Union and crucially remains within the EU single market.

In practice this means that there are now new requirements on NI firms transporting goods across the Irish Sea in terms of import declarations at the ports and some physical infrastructure for checks of goods. The NI protocol rules apply.

2 – Customs and shipping containers at Dublin Port

The main change that Exporters now face is that they need to declare goods being transported between ROI and Great Britain with a custom declaration form (submitted by your customs clearance agent or inhouse staff on special software).

All business should ensure they have their EORI number Economic Operators Registration and Identification system. Note that a GB/XI EORI may also be needed depending on your circumstances

3 – Pre-booking declarations for trucks on ferries

In the lead up to Brexit some claimed that Brexit-related checks could be easily streamlined using technology – and to a certain extent, they were right. A new IT system has been developed by Irish Revenue called Automated Import System (AIS) for roll-on roll-off ferry deliveries. Similarly a Good vehicle Movement System (GVMS) has been developed by the UK side.

There are three elements to this: one is the pre-boarding declaration.

A business exporting from Great Britain to Ireland must send a pre-boarding declaration of what the truck contains to Revenue, upon booking or checking-in with the ferry company.

The truck will not be able to board without this pre-boarding declaration – the same process will apply for goods being exported on trucks and by ferry from Ireland.

This process gives Revenue time to approve customs declarations as quickly as possible, and delegating as many vehicles as possible to the faster ‘green routing’ planned for ports. Thirty minutes before docking in Dublin Port or Rosslare Port, truck drivers will be able to check online to see whether they can take the ‘green lane’ exit from the port, or whether they will have to go through customs checks.

4. Transit via The UK landbridge

For businesses that are using the UK landbridge to deliver goods to and from continental Europe, they will need to declare their transit through the NCTS system. It is vital to ensure that you are approved to carry out this process in advance. Thus, you should consult with us well in advance regarding the Transit process.

5. SPS checks

New sanitary and phytosanitary (SPS) checks are now being carried out on certain goods being traded between Great Britain and Ireland.

Any business, regardless of size, which moves animals, plants, food products of animal origin and plant origin from, to or through Great Britain is now subject to new regulatory requirements. Documentary identity and physical checks form part of these new regulations. In addition to this if you import or export animal or plant products from GB you need to register with the department of Agriculture.

Irish importers of GB animal or plant goods may also need to register for the European Commission system ‘TRACES‘.

For the UK’s import control regime, particularly what SPS regime will apply for Northern Ireland, it’s a bit more complicated. In response to the Covid-19 pandemic, they announced that they would ‘phase in’ the additional post-Brexit checks and forms to help give businesses more time to prepare. Because of this, there is still some additional time to prepare for checks at the UK end.

6. Costs and changes for consumers

There are now additional costs to buying products from the UK.

If an item costs between €22-150, VAT and import costs will apply to it, while products from the UK that cost over €150 will have VAT, import and customs-duty costs.

Different rates of duty will apply depending the type of product being purchased.

You will need to pay these costs for parcels in a similar way that US goods ordered to Ireland are paid for – you may need to visit a post office to pay the charge before it is delivered to your house.

The CCPC has warned before that the consumer rights afforded to consumers in Ireland who buy products from the UK would be different after 31 December 2020.

Those resident in Ireland with British driving licences have been advised to change these for Irish Licences.

The CCPC Competition and Consumer Protection Commission has warned before that the consumer rights afforded to consumers in Ireland who buy products from the UK are different.